Disclaimer: This analysis is based on data provided by crunchbase.com, and some of the deals in the data set didn’t disclose the amounts invested in each company, and were therefore excluded from any dollar-value calculations. See the bottom of this post for more information.

The Venture Capital Scene in Egypt, on the surface, looks like it has been growing significantly over the last 3 years. This is very clear when you look at the total invested capital by stage:

Pre-seed: $5,707,417 (2019), $8,946,699 (2020 +56.76% ), $34,453,144 (2021 +285.09%)

Seed: $20,533,000 (2019), $24,863,000 (2020 +21.09%), $38,620,000(2021 +55.33%)

Series A: $14,540,000 (2019), $18,100,000 (2020 +24.48%), $199,898,491 (2021 +1004.41%)

It is understandable that 2020 saw modest growth given that it was the first year of the pandemic and investors were largely cautious due to the uncertainty of how things are going to unfold over time. In 2021 however, we have seen an explosion of venture capital around the world, and Egypt was no exception.

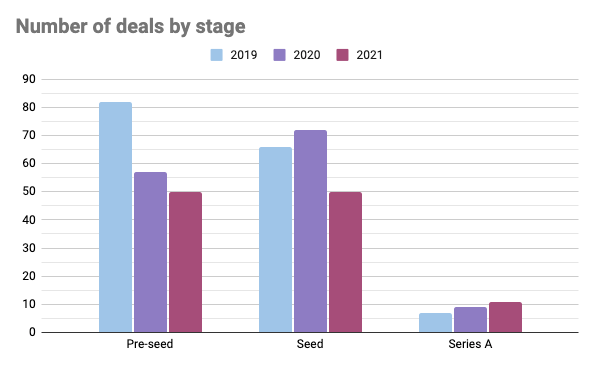

Have early-stage investors taken more chances on more entrepreneurs in 2021?

The surprising answer is No. If we look at the number of deals per year and stage, we see a very different picture. While we have seen a small uptick in Series A rounds, the number of both Seed and Pre-Seed rounds went down in 2021. Also keep in mind that the absolute number of Series A deals per year is very small (7 in 2019, 9 in 2021, and 11 in 2022).

Pre-seed: 82 (2019), 57 (2020 -30.49% ), 50 (2021 -12.28%)

Seed: 66 (2019), 72 (2020 +9.09%), 50 (2021 -30.56%)

Series A: 7 (2019), 9 (2020 +28.57%), 11 (2021 +22.22%%)

More capital is concentrated in a smaller number of deals

In general it is true, that investors are investing more per company than before. The median investment amount by stage has grown consistently over the last 3 years, however the biggest growth we have seen is really driven by the top 25% of companies in every company stage.

Let me give you an example. Let’s look at the median invested amount in the Pre-seed stage.

For the lowest 25th percentile of companies, the amount grew from $25,000 (2019), to $31,125 (2020), to $57,500 (2021).

The 50th percentile, the amount grew from $47,300 (2019), $81,850 (2020), to $125,000 (2021).

The top 25th percentile, the amount grew from $60,000 (2019), $192,500 (2020), to $1,000,000 (2021).

As you can see the top 25% have seen the biggest jump in the size of their investment rounds, with everyone else not really seeing a significant change in the amount of funding they are receiving. This shouldn’t come as a surprise with outliers like Rabbit raising $11m, Telda raising $5m, and Flextock raising $3.5m.

The top 3 companies in the Pre-seed stage (Rabbit, Telda, and Flextock) raised more than 56% of all invested Pre-seed capital in Egypt in 2021, with Rabbit single-handedly responsible for 32%.

We see a very similar story if we look at Seed stage investments, albeit not as dramatic. You find outliers in the Seed stage as well with Taager raising $6.4m, and Sympl raising $6m, and Cartona raising $4.5m.

The top 3 companies in the Seed stage (Taager, Sympl, and Cartona) raised 43.8% of all invested Seed capital in Egypt in 2021.

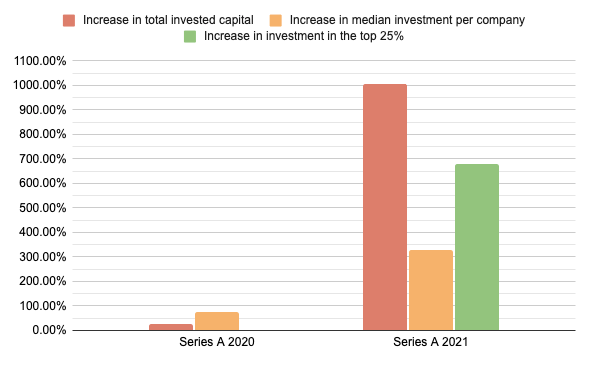

When we look at Series A investment rounds, we haven’t seen the top 25% of deals grow in size in 2020 at all, however in 2021 that changed with a whopping 681% increase. The biggest Series A deals in 2021 were MaxAB raising $55m, Trella raising $42m, and Capiter raising $33m.

The top 3 companies in the Series A stage (MaxAB, Trella, and Capiter) raised 65% of all invested Series A capital in Egypt in 2021.

What does this mean for founders?

It is becoming more competitive to raise capital in Egypt, but if you are successful you are likely to raise more capital than you would have in previous years.

I believe this is driven by the uncertain economic climate due to the impact of the pandemic, leading to a smaller number of investors participating in high-risk investment opportunities such as venture capital, especially when the public equities market has shown a very remarkable performance in 2021.

This is further highlighted by the fact that if we look at the last 3 years, 2021 was the lowest in terms of of the number of new emerging local VC funds.

What does this mean for investors?

There is a very big opportunity for investors to take more bets on more up and coming startups. As it is commonly said, venture capital returns follow a power-law distribution, and therefore the success of venture capital firms relies on taking more changes to find the one of two winners who would make the fund profitable.

I hope with the correction we are seeing in the public equities market, we would see more institutional investors taking the opportunity to invest in early-stage venture capital in Egypt.

Disclaimer: Availability of investment round figures

The data available in Crunchbase does not provide exact figures for the amounts invested in each company. The data available though provides a coverage that ranges between 55% and 83%, so I believe this is good enough to at least directionally provide some insights on the evolution of the early stage VC market in Egypt.