Comparison: Early Stage VC in Egypt vs. UAE

Recently I have been taking a lot of interest in forming a deep technical understanding of the startup scene in the MENA Region, and more specifically in Egypt. In a previous post I analyzed the development of Early Stage Venture Capital in Egypt over the last years and what it means for founders and investors.

Egypt and the UAE are two of the hottest startup ecosystems in the MENA region, so in this post I compare the evolution of Early Stage VC in both countries.

10-Year Trends

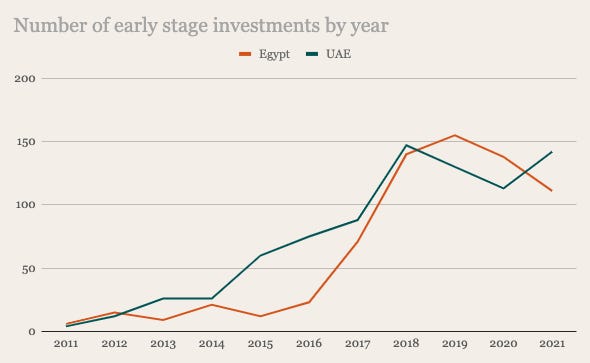

Egypt and UAE are almost head-to-head when it comes to number of investments.

Between 2012 and 2016, the UAE startup ecosystem significantly outpaced the Egyptian ecosystem in terms of number of investments per year. From 2017 onwards however, we see Egypt catching up with a steep increase in the number of early-stage investments, to even outpace the UAE in the years of 2019 and 2020. Egypt in 2021 saw a decline in the number of early stage investments as we saw in my previous post, but the UAE saw very interesting growth in the same year.

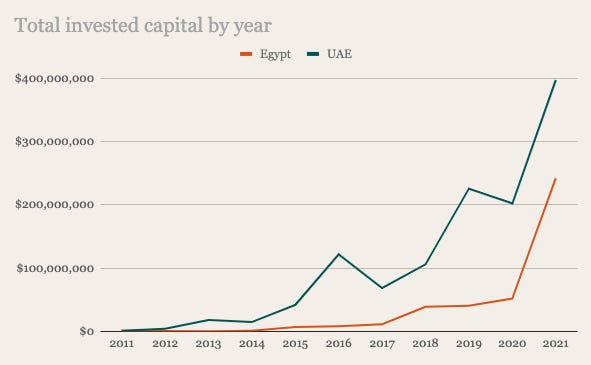

UAE significantly outpaces Egypt in terms of total invested capital

When we look at the total invested capital instead of number of deals, we see a very different story with the UAE consistently outpacing Egypt over the last 10 years. This is driven mainly by a much stronger Seed-stage investment market, as well as — on average — bigger Pre-Seed and Seed investment rounds as we will see later in this post.

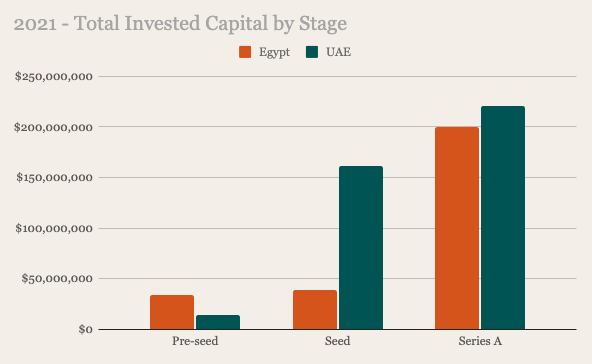

2021 Trends

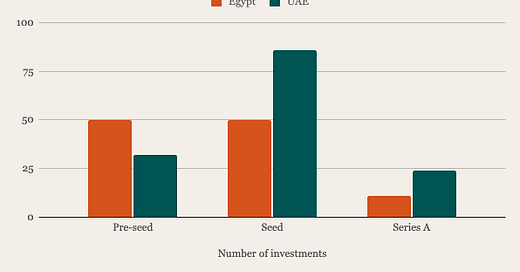

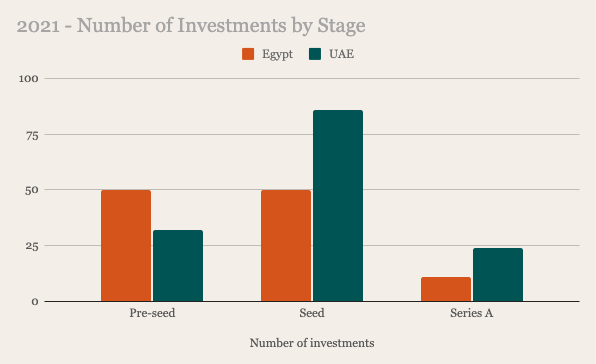

UAE shows very strong growth in Seed stage investments

Egypt outpaced the UAE in terms of Pre-Seed investments (UAE lower by -57.68%), and they went almost head to head in Series A (UAE higher by 10.48%), but it is really in the Seed Stage where the UAE shines with a +318.76% difference compared to Egypt. UAE Seed stage startups raised a total of $161.7m, compared to Egyptian See Stage startups who raised only $38.6m.

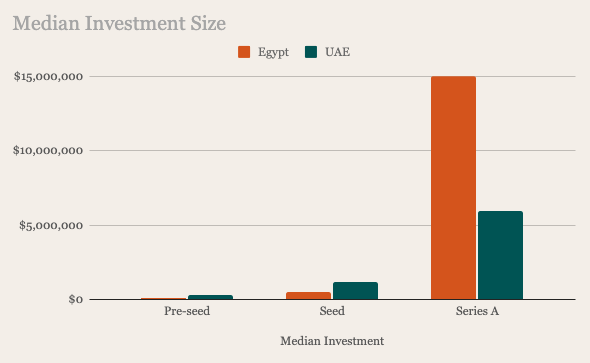

Series A rounds in Egypt are bigger than the UAE

When we compare the Median Investment by stage in Egypt and the UAE we see Egyptian startups doing better in Series A, but we see startups in the UAE doing better in Pre-Seed and Seed:

Series A: Egypt $15,000,000, UAE $5,966,202 (-60.23%)

Seed: Egypt $525,000, UAE $1,200,000 (+128.57%)

Pre-Seed: Egypt $125,000, UAE $290,000 (+132.00%)

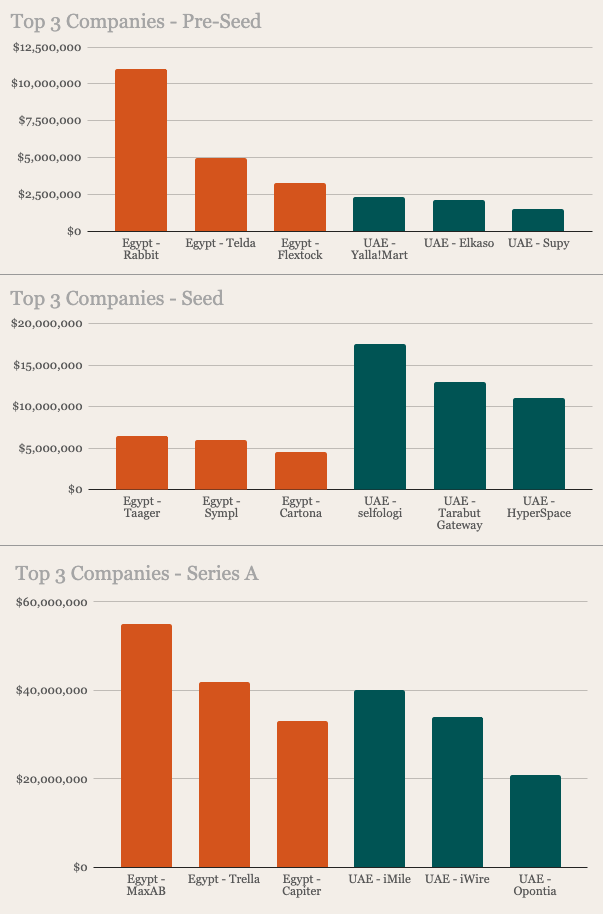

The top Egyptian Startups are raising more capital than the top UAE Startups, except in Seed rounds

As you can see in the charts above, the top 3 Egyptian startups in both Pre-Seed and Series A have raised more capital than their counterparts in the UAE, while in the Seed Stage the UAE startups are doing significantly better than Egyptian startups.

Key Takeaways

Investors in Egypt need to write bigger Seed cheques, and they need to write them more often

I personally believe that the ticket sizes that we are seeing in Egypt are too small to enable any fast development of the ecosystem and they don’t give startups enough capital to find product-market fit. This is probably because of some legacy investors who started investing 5-6 years ago in EGP instead of USD (the currency exchange rate working against them), and have set the market standard for the average ticket size. The market dynamics have changed quite a lot since then, and the talent market is becoming increasingly more competitive, and investors need to catch up.

Investors also need to take more chances on more entrepreneurs. As I wrote in my previous post, this concentration of investment in a very small number of companies is even detrimental to the success of some of the VCs themselves who have a very small portfolio of companies.

Egyptian outliers are worth betting on

As we saw in the data, there are some remarkable outlier startups in the Egyptian ecosystem. They have done a great job in building successful businesses and were able to raise significant amounts of capital. This means that investors have a great opportunity in the future growth of current and upcoming Pre-Seed and Seed stage companies in Egypt, but for them to really find these outliers, they have to - you know where this is going - take more chances on more entrepreneurs and write bigger cheques.

Disclaimer: All information is based on data available on crunchbase.com