Understand risks, balance risks, then take more risks. Sounds simple enough right?

In my experience working at startups, I found one thing in common among the most successful people and the most successful companies, and that is their ability to reason about risk in a way that others usually can’t.

Before we dive into this post, I want to get one thing out of the way. If you, dear reader, would stop reading here, there is one key takeaway I’d like you to have, and that is that almost everything that you consider to be risk, isn’t actually risky at all. Most people lean naturally to risk-aversion, and while there are no hard and fast rules, it is still very likely that you are exaggerating the risk involved in any given decision. People often tell me that I have a higher tolerance for risk but that isn’t true - I am just very pragmatic about whether something is a real risk or not and I don’t let my emotions control that decision. Now let’s dive into our topic.

Understanding risk: Risky != Speculative

One common mistake I see people making is conflating risk and speculation. Doing something risky is not the same as shooting in the dark. Shooting in the dark is reckless, whereas taking a risk is a calculated move. Taking risks is about understanding the different possible outcomes and their likelihood, and making a decision based on your willingness to accept failure in exchange for a potential higher outcome.

If the risks that you are taking are not grounded in data or a solid understanding of the parameters of the decision, then what you’re really doing is gambling and not risk-taking. Our jobs as startup operators sometimes need a little bit of gambling, but as we are going to see in the next section of this post, you should carefully manage the amount of gambling in your work and keep it to a minimum. I like to tell my team that my job is 90% chess (calculated moves), and 10% poker (gambling), so every now and then I’ll ask them to take a chance with me and try out something audacious, but the rest of the time we’re methodical, structured, and grounded in data.

Balancing risks: A diversified portfolio

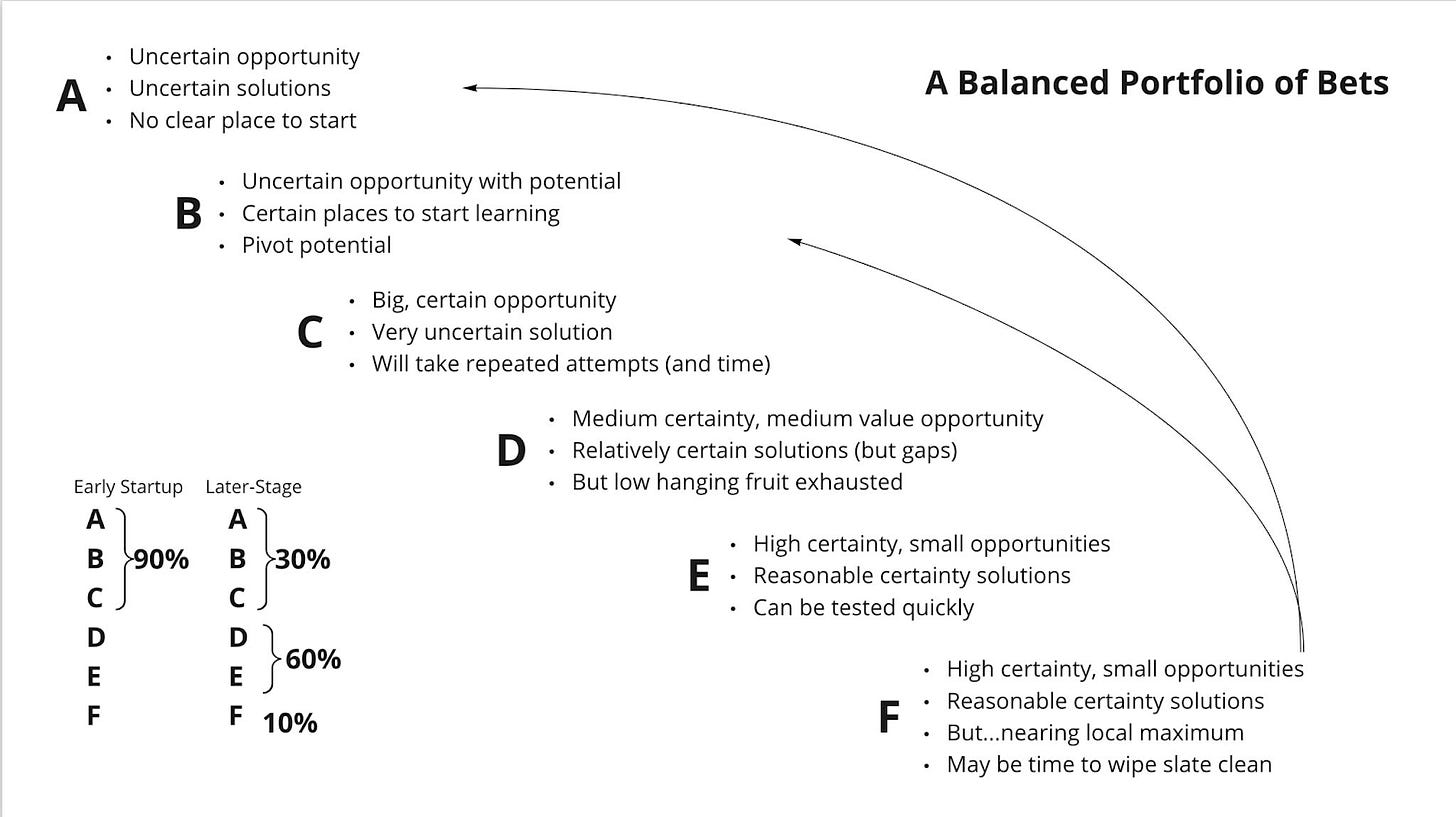

When it comes to balancing risk, John Cutler does a fantastic job explaining this in the framework you see above.

You need to think of your risks as an investment portfolio. A good investor doesn’t put all their money into high risk assets, but they rather diversify. To construct a good investment portfolio, you will need a good balance of high-risk opportunities, medium-risk opportunities, and low-risk opportunities. If you’re an investor and you put 100% of your money in crypto, then you might see outsized returns but you might also see all or your investments go to zero. On the other hand if you want to play it safe and and put all your money in bonds, the chances of your investments going to zero are very low, but your upside is capped at a couple of percentage points a year. A diversified portfolio hedges your bets and gives you the opportunity to strike the right balance between potential returns and potential losses.

Take more risks: Continuous Validation

As we saw in the section above, every team should decide for themselves what is their equivalent of their “risk” quota, and in order to maintain a diversified portfolio, they need to maintain that quota and never really go under nor really go over. A “risk” is inherently time-bound too. Sooner or later, a risk should end up either materializing, or simply disappearing. The way this usually happens is after enough time passing, the moment of observation comes and we can clearly see whether what we thought might happen, in reality happened or not.

In the context of running a startup, you don’t want to spend a lot of time “waiting” to validate your risks, so this is why you need to tackle your risks (especially the bigger ones) early and often. Prototyping and experimentation are common ways for teams to validate their risks quite early in the process, and forcing that moment of observation without having to wait too long. Once you have validated you risks, you free up some of your “risk” quota, which you should then reinvest by taking additional risk and repeating that full cycle again. That’s how you keep innovating, how you keep pushing the envelope, and how you drive high growth in your business.

I’d love to hear from you, so if you have any thoughts you would like to share, please do so in the comments, or find me on Twitter.